Capital. Strategy. Relationships that Build Legacies.

Since 2019, we’ve closed over $600M in real estate and business transactions—helping entrepreneurs, investors, and families access the alternative capital and opportunities.

Capital. Connection. Clarity.

Funding solutions, Private Investor Clubs, and advisory services—built for serious players in private markets.

Capital

Need to access the funding and resources required to grow your vision?

Connection

Want to leverage an exclusive network and unique opportunities unavailable elsewhere?

Clarity

Looking for tailored strategies to safeguard wealth, maximize returns, and create long-term impact?

Is Your Growth Stalled by These Challenges?

Struggling to Access the Right Financing?

Lack of capital is preventing you from reaching your goals and seizing opportunities.

Facing a Limited Financial Partner?

Without a trusted financial partner, growth opportunities are slipping away.

Frustrated with Missed Opportunities?

You’ve achieved success, but your next milestone feels just out of reach due to limited resources.

Unlock Your Next Level of Growth with Canady Investments

Tailored Financing Solutions:

We craft customized strategies based on your specific goals.

Dedicated Advisors: Receive expert support at every step of the way.

Streamlined Applications: Say goodbye to overwhelming paperwork.

Funding Designed to Match Your Vision.

PROVIDING CAPITAL FROM $20,000 TO $50,000,000

For Borrowers Business Financing Solution

Factoring

Provides fast cash by selling your invoices, improving cash flow without waiting for payments.

Account Receivable

Invoice Financing lets businesses borrow against unpaid customer invoices to boost cash flow.

Equipment Financing

Help Businesses purchase or lease equipment by providing loans or leases, paid back over time.

SBA Financing

Government-backed loans for business growth.

Lines Of Credits

Flexible funds for short-term needs.

Business Term Loan

Fixed loans for big expenses

Government Contract Funding

Finance to fulfill government contracts

Business Debt Relief

Restructure and manage business debt.

Top Industries

Construction

Retail

CANNABIS

MANUFACTURING

Technology

Healthcare

Transportation

ENERGY

Food Service

Automotive

ENTERTAINMENT

Funerals

Build, Buy, and Refinance with Elite Private Financing Options

Comprehensive financing options to elevate your strategy.

Single-Family Residential

Financing for ground-up construction, fix & flip, and long-term rental investment strategies.

Ideal for developers, builders, and investors scaling their residential portfolios.

Loan Amount: $250,000 - $10 Million

Term Options: 12, 24, or 30-Year Fixed

(for long-term rental financing)

Maximum Loan-to-Value (LTV):Up to 80%

Structure: Interest-Only Payments Available

Rates: 6.50% (Rental Properties – DSCR Loans)

10.99% (Short-Term Bridge & Hard Money Loans)

Closing Timeline: As Fast as 7 Days

Use of Funds: Land acquisition, new construction, renovation, fix & flip, cash-out refinancing

Eligible Asset Types:

Single-Family (1-4 Units)

Bridge & Construction Loans

Build-to-Rent (30-Year DSCR Loan Options Available)

Mid-Sized Commercial & Mixed -Use

Designed for experienced developers and investors seeking capital for ground-up construction, renovations, or repositioning of income-producing assets.

Loan Amount: $500,000 - $25 Million

Term Length: 12 - 24 months

Maximum Loan-to-Value (LTV): Up to 75%

Structure: Interest-Only Payments

Rates: Starting at 10.99%

Closing Timeline: 14 - 28 Days

Use of Funds: Land acquisition, new construction, repositioning, cash-out refinancing, light renovations

Eligible Asset Types:

Multifamily (5+ units)

Mixed-Use Developments

Retail Centers

Office Buildings

Light Industrial

Warehouses

Self-Storage Facilities

Large-Scale Development & Luxury

Achieve success in fix & flip projects. Whether a first-time buyer or expanding your portfolio, our financing supports your real estate goals.

Loan Amount: $500,000 - $50 Million

Term Length: 12 - 24 months

Maximum Loan-to-Cost (LTC): Up to 85%

Maximum Loan-to-After-Repair Value (LT-ARV): Up to 65%

Structure: Interest-Only Payments

Rates: Starting at 10.99%

Closing Timeline: 21 - 35 Days

Use of Funds:

Ground-up construction of luxury residential & commercial assets.

Repositioning, adaptive reuse, or redevelopment of existing assets.

Build-to-Rent & Build-to-Sale Communities.

Cash-Out Refinancing on completed projects.

Eligible Asset Types:

Luxury Single-Family Residences (SFR Spec Homes)

Multifamily Value-Add & New Development (5+ units)

Mixed-Use Properties

Condo Developments & High-Rise Construction

Property Types

Adult Day Care

Church

Gym

Hotels

SENIOR LIVING

Cinema

HealthCare

INDUSTRIAL

assisted LIVING

Condo

Retail

Data Centers

Auto Dealership

Event Center

SChools

Mixed Used

Carwash

Gas Stations

RV Parks

Parking Lots

Casino

GoLF

Hospitals

MARina

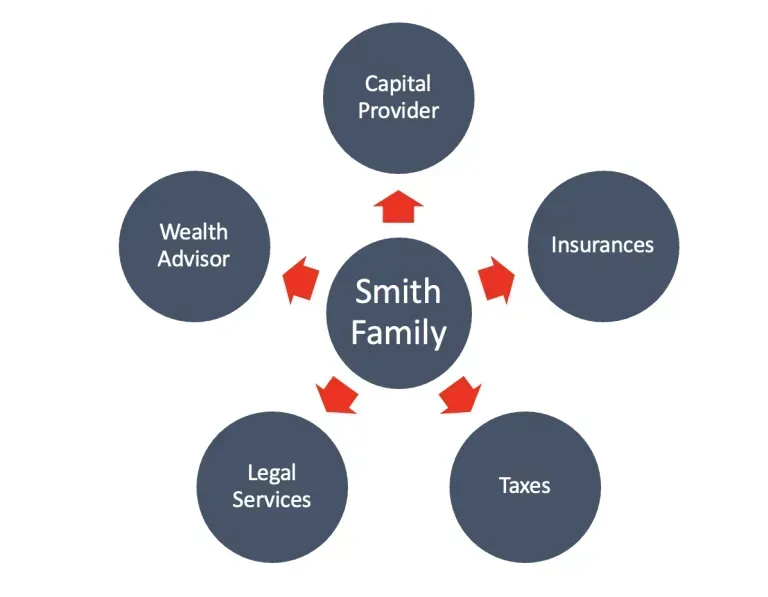

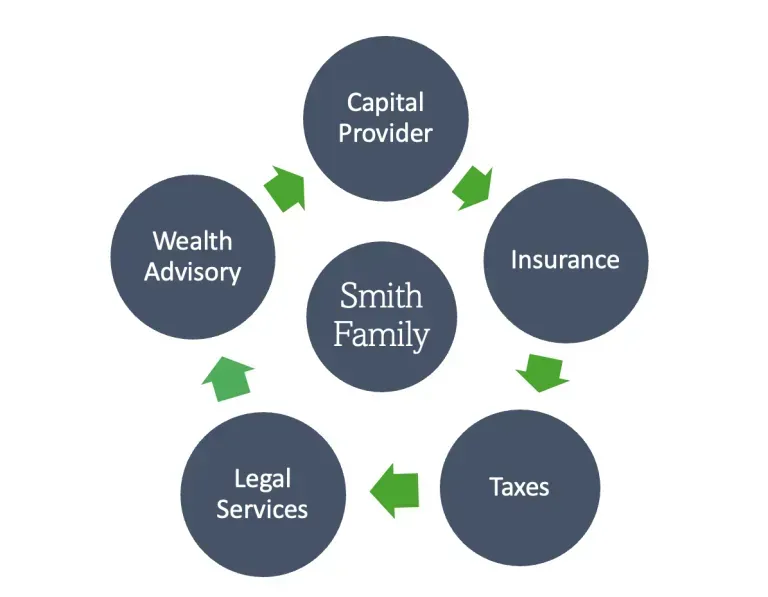

Advisory Services: Example: Smith Family

Before Your Wealth Assessment

Fragmented Wealth Management: Multiple advisors often lead to inefficiencies and missed opportunities.

Inconsistent Strategy: The lack of a cohesive plan can result in uncoordinated investments and suboptimal outcomes.

High Risk Exposure: Disjointed financial management increases vulnerability to market fluctuations and legal risks.

After Your Wealth Assessment

Centralized Wealth Oversight: A unified, holistic financial strategy that brings all elements of wealth management under one roof.

Enhanced Decision-Making: Financial decisions are strategically aligned with your long-term goals, ensuring consistent growth.

Improved Risk Management: Comprehensive protection against market, legal, and economic risks, safeguarding your wealth.

If you had a team that could handle your wealth, investments, taxes, and legacy seamlessly, would you take it, or keep juggling it all yourself?

Join Our Exclusive Private Capital Club

An invitation-only membership for elite professionals. Our network is a private ecosystem where capital, strategy, and influence converge to create transformative opportunities.

Featured Membership Categories (5 Pillars)

Commercial Real Estate

Top brokers unlocking premier property deals for club members.

Business & M&A Advisory

Participate in high-yield, fully vetted real estate and business financing.

Wealth & Financial Management

Elite wealth managers connecting HNW clients to private capital.

Legal & Accounting Expertise

Attorneys and Accountants providing precision, compliance, and strategic guidance for complex deals.

Capital & Execution Partners

Private lenders, cash buyers, and contractors who bring deals to life with speed and certainty.

Disclaimers:

Private investment opportunities are offered only to accredited investors. Participation is restricted and not available to the general public.

Investments involve risk, including possible loss of capital. Past performance does not guarantee future results.

All offerings are private, confidential, and structured in accordance with applicable securities laws and regulations.

This website is for informational purposes only and does not constitute an offer to sell or solicitation to invest.

Investors must complete verification and an accredited investor questionnaire before accessing private investment opportunities.

Financial Insights

Small Call to Action Headline

Leadership You Can Trust.

Behind every deal is a team of professionals committed to client success.

Ashley Rivera

Managing Partner, Advisory Services

Ashley is an accomplished financing professional with over a decade of experience delivering results for accredited investors. She was part of the team behind Marcus by Goldman Sachs and has experience at EY and Bridgestone Crest, with a strong command of forecasting, pro forma analysis, and financial development, combining deep expertise with a passion for building lasting client relationships.

Trae'Vorris Canady

Founding Managing Director

With over a decade in elite financing, our founder has built and leads a select team of licensed fiduciaries, legal, and accounting experts, guiding sophisticated investors and businesses through tailored capital strategies. Together, we’ve executed over $620M in transactions across all 50 states. This year, we are proud to champion Black Top Academy as our nonprofit of the year, reflecting a commitment to impact beyond finance. Looking ahead, our mission is clear: $2 billion in transactions over the next 5–7 years, reserved for those who value discretion, expertise, and results.

Janina August

Managing Partner, Real Estate Capital & Finance

Janina August is a financial professional with over a decade of experience in real estate lending, financial services, and branch management. She has held key roles at Ochsner Health System, and Republic Finance, where she excelled in credit analysis, risk assessment, and client education, consistently helping clients maximize opportunities. Known for her leadership, relationship-building, and operational expertise, Janina drives growth and delivers results with precision and impact.

Build Your Financial Future – 4 Simple Steps

1. Complete Your Intake Form:

Share a few key details about your business, real estate, or investment goals.

2. Answer Our Pre-Qualification Questions:

Help us understand your vision so we can recommend the right funding, advisory, or partnership solutions.

3. We Review and Strategize:

Our team of experts evaluates your submission and begins crafting a personalized plan to support your growth.

4. Receive Your Personalized Response Within 24 Hours:

You’ll get a high-touch reply outlining next steps, funding options, or strategic advisory recommendations—all designed to build a lasting partnership.

Recent Transactions

Equipment Financing

Government Contracting Financing

Rate & Term Refi

Ground Up Construction

STILL NOT SURE?

Exclusive FAQ: Your Questions, Answered by Experts

Why should I work with Canady Investments instead of a traditional bank?

Banks follow rigid guidelines and slow processes. We provide tailored solutions, fast execution, and access to private capital that aligns with your strategic goals—unlocking opportunities others can’t.

I’ve never worked with a private lender—how do I know it’s safe?

We operate with full transparency and partner with licensed fiduciaries, attorneys, and accountants. Every transaction is structured to protect your capital while maximizing returns.

I’m concerned about fees and hidden costs. How does your pricing work?

We provide clear, upfront terms. There are no surprises—just strategic, performance-based fees that align with your outcomes. Your success is our priority.

My project is complex—can you handle it?

Complexity is our specialty. From real estate to business financing to government contracts, we structure creative solutions that traditional lenders can’t. We thrive where others see obstacles.

I’m hesitant to commit. What if this doesn’t work out?

Our approach is consultative. We begin with a complimentary wealth assessment and feasibility review, ensuring every strategy is tailored to your risk tolerance and objectives before you commit.

How quickly can I access funding?

While timelines vary by project, our private capital network allows for much faster funding than conventional lenders—often in days, not weeks.

Do I need prior experience with investing or real estate?

No. We guide you through every step, leveraging our expertise and network to make complex deals simple and profitable.

What makes Canady Investments different from other private lenders?

It’s our combination of strategic insight, exclusive network, and hands-on support. We don’t just fund deals; we architect success.

Join Our Partner Referral Program

Grow Your Business, Earn More, and Get the Tools You Need to Succeed.

Personalized Landing Page:

A Co-Branded landing page to help you generate leads and showcase your partnership with Canady Investments.

Marketing Materials

Professionally designed flyers, brochures, and digital content to promote your referral program effectively.

Online Partner Portal:

Track your referrals, monitor deal progress, and access exclusive resources in real-time.

Take the Next Step Toward Strategic Growth!

You’ve seen how tailored guidance, exclusive capital access, and expert insight can transform opportunities into results. Now it’s your turn. Complete the intake form below to get started—your personalized assessment awaits.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Quick Links

LEGAL & Compliance

Subscribe to Our Exclusive Monthly Newsletter!

______________________________

Stay ahead with insider tips, exclusive updates, and expert insights delivered straight to your inbox.

Copyright 2026. Canady Investment & Acquisitions, LLC. All Rights Reserved.