Strategies for Lasting Family Wealth

Explore strategies that enhance and preserve your family’s wealth, aligning with your deepest values for a meaningful legacy.

Why Partner with Us?

1. Family Wealth Creation: Tailored advice to help your family thrive financially now and for generations.

2. Holistic Wealth Management: Comprehensive care for every financial aspect of your family’s life.

3. Focused Expertise: Our dedicated team of family wealth experts offers personalized, expert guidance.

The Missing Piece in Your Financial Puzzle

As a Capital Provider, I’ve had the privilege of meeting some truly remarkable clients—visionaries with big dreams and the drive to make them happen. But too often, I’ve seen these same clients struggle, not because they lack potential, but because their financial teams just aren’t up to the task. Deals fall through, opportunities slip away, and the frustration mounts.

It’s a common problem: a brilliant entrepreneur paired with a financial team that can’t keep up. The numbers don’t add up, the strategies are off, and the advice is either outdated or just plain wrong. It’s painful to watch as great ideas falter simply because the financial foundation isn’t strong enough.

But it doesn’t have to be this way. At Canady Investments, we understand that the right financial partner can make all the difference. We bring the expertise, insight, and strategic thinking needed to transform potential into success. With us by your side, you can be confident that your financial team is as solid as your vision.

Don’t let poor financial guidance hold you back. Complete your custom plan with Canady Investments

today, and let’s build the foundation that turns your dreams into success. Your vision deserves nothing less than the best.

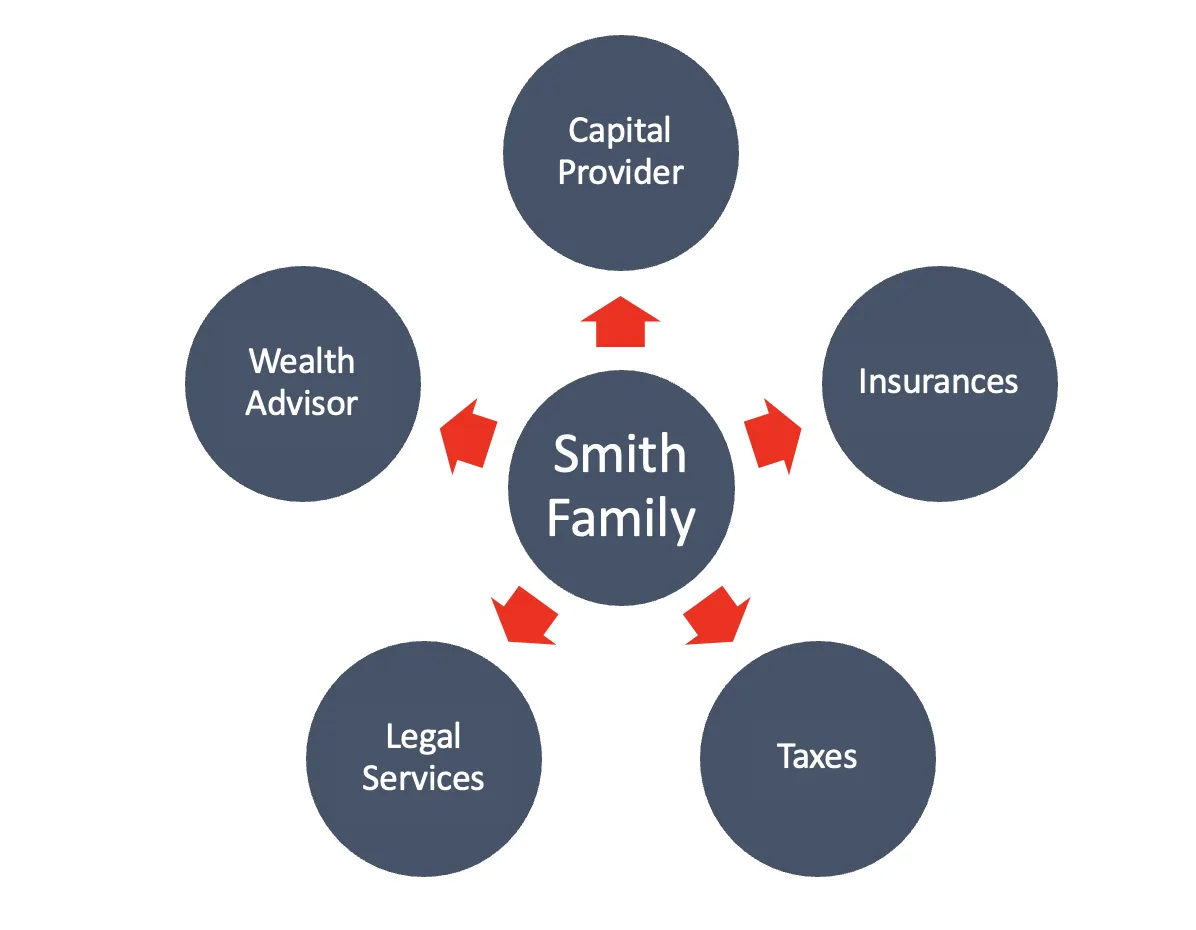

Before

Fragmented Wealth Management: Multiple advisors often lead to inefficiencies and missed opportunities.

Inconsistent Strategy: The lack of a cohesive plan can result in uncoordinated investments and suboptimal outcomes.

High Risk Exposure: Disjointed financial management increases vulnerability to market fluctuations and legal risks.

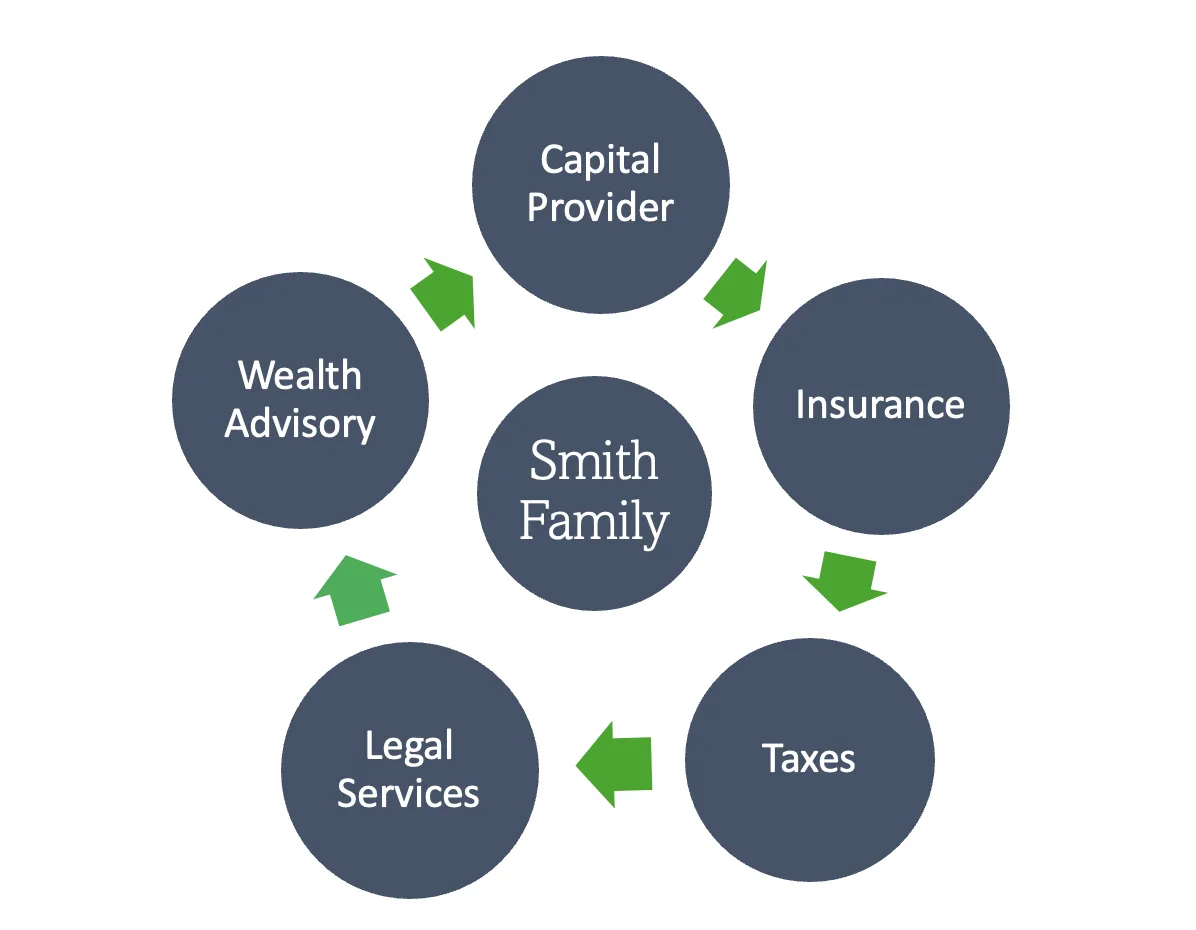

After

Centralized Wealth Oversight: A unified, holistic financial strategy that brings all elements of wealth management under one roof.

Enhanced Decision-Making: Financial decisions are strategically aligned with your long-term goals, ensuring consistent growth.

Improved Risk Management: Comprehensive protection against market, legal, and economic risks, safeguarding your wealth.

Private Client Service Benefits

Secure fast capital, access exclusive opportunities, and benefit from strategies tailored to your unique vision.

Streamlined Access to Capital and Resources

Quickly and efficiently secure the funding and tools you need to propel your ventures forward.

Exclusive Access

Benefit from our powerful network and insider opportunities that others can’t offer.

Customized Strategies

Every solution is crafted to fit your specific goals, ensuring maximum impact and succes.

Private Client Process

Here’s how we work together to make things smooth and straightforward.

01

Wealth Management Assessment

Comprehensive analysis to understand your current financial standing and goals.

02

Client Interview

In-depth discussion to identify your objectives, values, and aspirations.

03

Orientation

Introduction to our strategic plan tailored to your needs.

04

Implementation

Execution of the customized strategy to achieve your financial goals.

STILL NOT SURE?

Private Client Services FAQ

We understand lorem ipsum dolor sit amet, consectetur adipisicing elit.

What exactly are Private Client Services?

Private Client Services are tailored financial solutions that cater exclusively to the needs of high-net-worth individuals and families, focusing on wealth management, estate planning, and personalized financial strategies.

Who qualifies for Private Client Services?

Our services are designed for accredited investors—individuals or families with significant investable assets—who seek customized financial planning and asset management tailored to their unique needs.

What can I expect from my initial consultation?

During your initial consultation, we’ll discuss your financial goals, current financial situation, and potential strategies to optimize your wealth. It’s a no-obligation meeting that sets the foundation for your customized wealth management plan.

How is wealth management within Private Client Services different from regular financial advising?

Wealth management for our private clients involves a more in-depth, holistic approach that includes estate planning, risk management, and tailored investment strategies, all designed to protect and grow your wealth comprehensively.

Can Private Client Services help with estate planning and inheritance?

Absolutely. We offer expert guidance in estate planning, including drafting wills, managing trusts, and planning for inheritance to ensure your legacy is preserved and passed on according to your wishes.

What kind of personal attention will I receive?

Each of our private clients is assigned a dedicated advisor who is responsible for overseeing your entire financial picture. Regular meetings ensure strategies remain aligned with your life changes and financial goals.

How do you ensure confidentiality and security of my financial information?

Client confidentiality and data security are paramount. We employ state-of-the-art security measures and strict confidentiality protocols to protect your information at all levels of our engagement.

How are fees structured for Private Client Services?

Our fee structure is transparent and tailored according to the complexity of services provided. We often operate on a fee-based system rather than a commission-based one, ensuring our advice is always in your best interest.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Follow us to receive all the latest updates

817-768-3117

Our Mailing Address:

539 W. Commerce St #866

Dallas TX, 76208

Resources

COMPANY

Quick Applications

Important Notice: Please Read Before Using Our Services

The information presented on this website serves exclusively for general informational purposes. Our website provides non-QM lending, direct lending, brokering services, and business purpose lending. The content herein is not intended to serve as legal, financial, or investment advice. We strongly recommend consulting with qualified professionals and conducting thorough research before making any financial decisions. For detailed information on our Privacy Policy and our complete Disclaimer, kindly visit the respective sections by clicking here.

© 2024 Canady Investments. All Rights Reserved. | Privacy Policy | Terms of Service